Financial professionals today face the dual challenges of growing data complexity and the need for rapid, accurate insights. Anthropic’s Claude for Financial Services is reshaping this landscape by unifying disparate data sources, automating analysis, and elevating decision-making through cutting-edge AI integration.

Unified Data, Streamlined Workflows

Claude’s Financial Analysis Solution aggregates financial data from live market feeds to internal proprietary datasets into a single, cohesive interface. This powerful consolidation, complete with direct source links, allows users to quickly verify information and access crucial data. As a result, teams spend less time on manual data wrangling and more time driving actionable insights, especially during market volatility or tight deadlines.

Image Credit: Anthropic

Unmatched AI Capabilities

Claude 4 models set new industry standards for financial research. In rigorous testing, the Claude Opus 4 model outperformed other AI agents in Excel-based tasks and financial modeling. Its flexibility extends further with Claude Code, which supports trading system modernization, compliance automation, and advanced risk modeling.

- Enterprise-scale usage limits

- Pre-built connectors for seamless integration with leading financial data providers

- Expert onboarding and best practices for rapid adoption

Data Security and Regulatory Compliance

Data privacy remains a top priority. Claude ensures that sensitive client and organizational data is never used to train generative models by default, adhering to the highest standards for security and compliance in the financial sector.

Building a Comprehensive Data Ecosystem

Claude integrates effortlessly with major financial and enterprise technologies, giving users real-time access to:

- Box for secure document storage

- FactSet and Morningstar for market research

- PitchBook and S&P Global for private market data

- Databricks and Snowflake for unified analytics

- Palantir for enterprise data integration

This robust ecosystem not only streamlines research but also strengthens reliability, enabling users to verify data across multiple trusted sources. The result: fewer errors and greater transparency.

Image Credit: Anthropic

Accelerating Enterprise Adoption

Anthropic’s partnership network featuring Deloitte, KPMG, PwC, Slalom, TribeAI, and Turing equips clients with both technical expertise and tailored solutions. These collaborations accelerate AI adoption for compliance, productivity, code modernization, and operational transformation throughout the financial sector.

Financial Analysis Solution includes:

- Claude’s industry-leading financial capabilities: Claude 4 models outperform other frontier models as research agents across financial tasks in Vals AI's Finance Agent benchmark. When deployed by FundamentalLabs to build an Excel agent, Claude Opus 4 passed 5 out of 7 levels of the Financial Modeling World Cup competition and scored 83% accuracy on complex excel tasks.

- Claude Code and Claude for Enterprise with expanded usage limits: Modernize trading systems, develop proprietary models, automate compliance, and run complex analyses including Monte Carlo simulations and risk modeling with Claude Code. With Claude, analysts can handle demanding workloads across critical market events and deal deadlines.

- Pre-built MCP connectors: Access financial data providers and enterprise platforms for comprehensive market data and private market intelligence.

- Expert implementation support: Tailored onboarding, training, and best practices for rapid value realization.

Real-World Impact in Financial Workflows

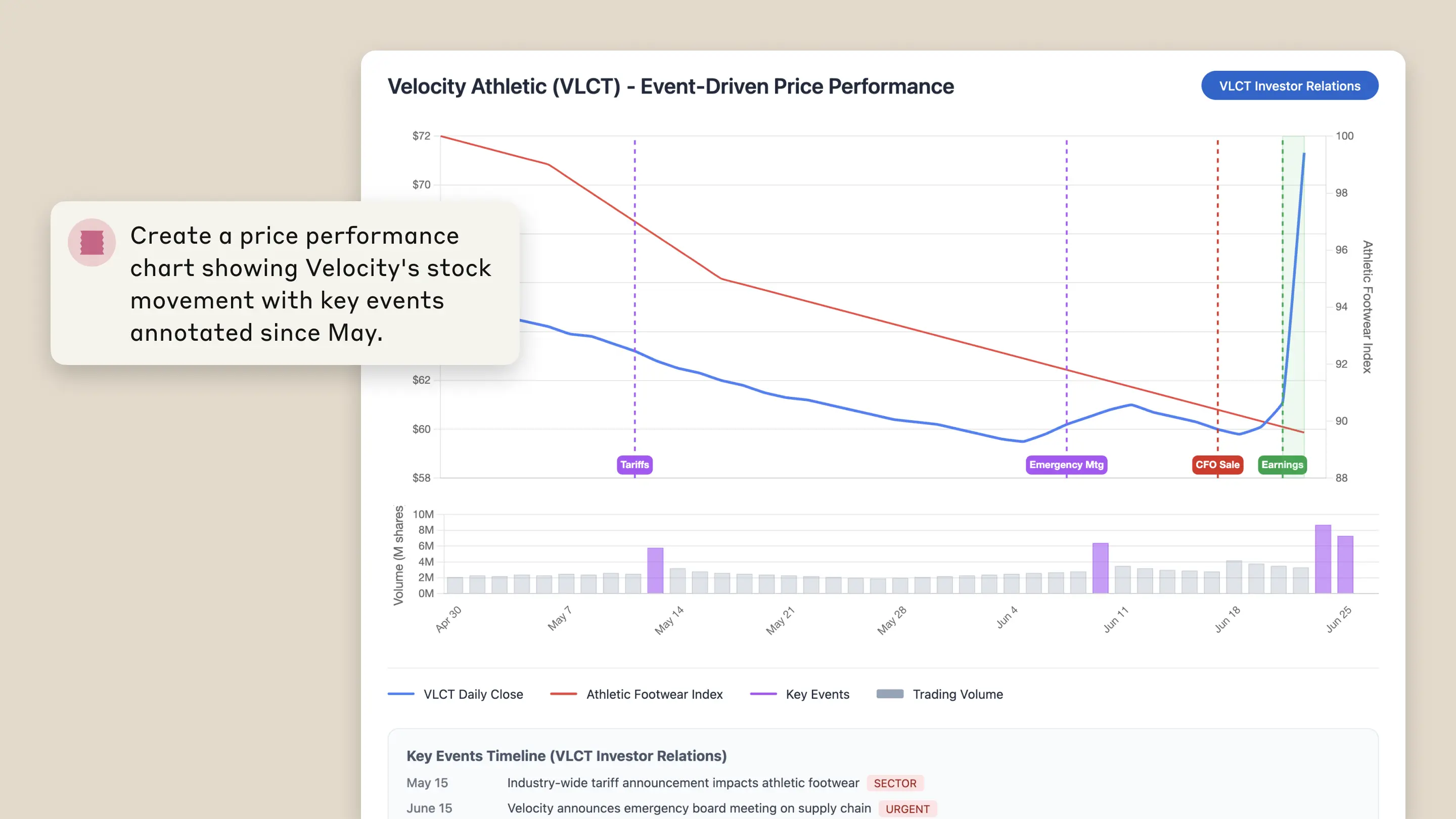

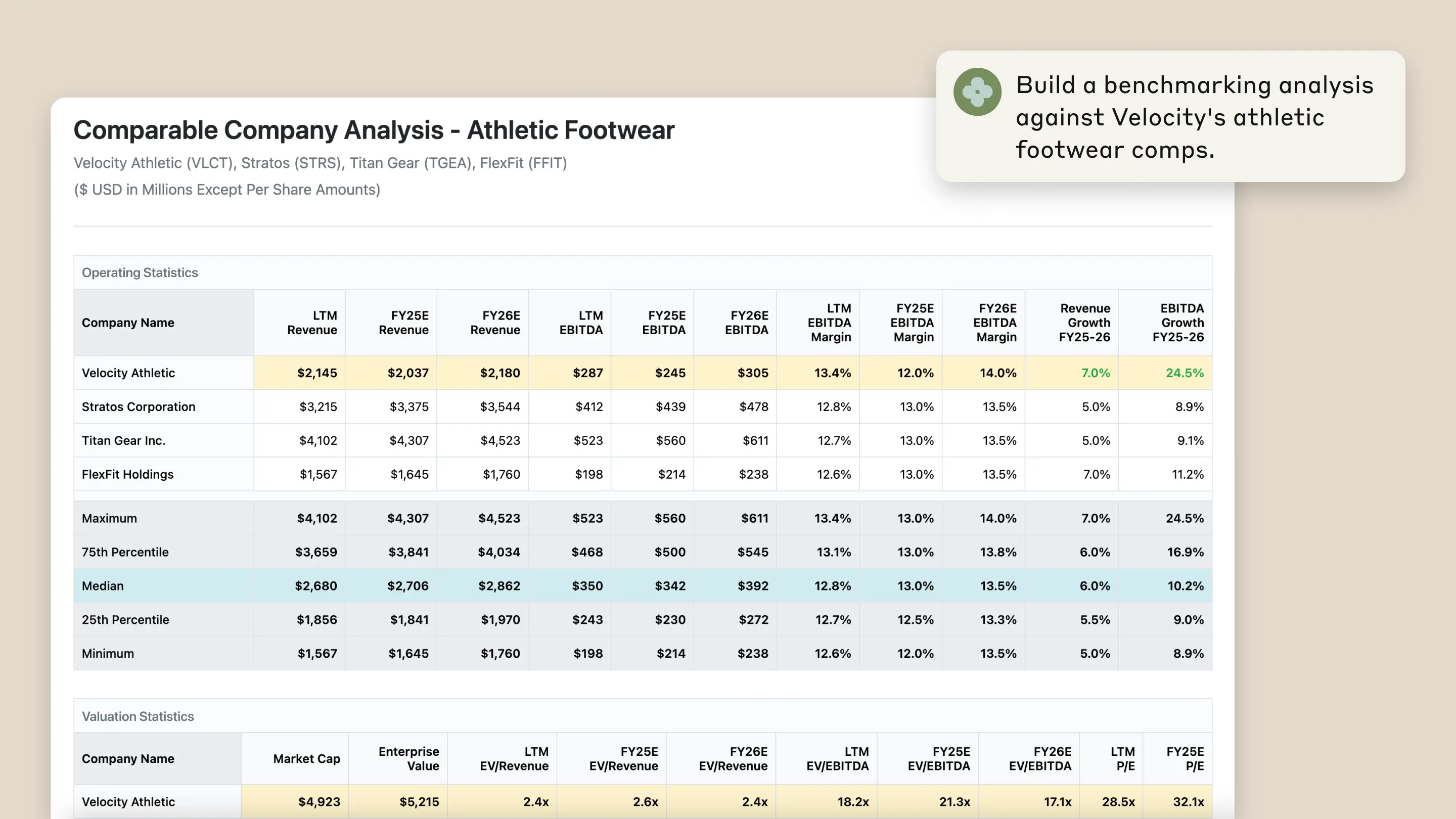

Claude is already transforming key investment workflows such as due diligence, benchmarking, and portfolio analysis. Teams leverage AI to produce audit-ready reports, investment memos, and pitch decks with unprecedented speed and accuracy.

- Automated market research and due diligence

- Audit-trail financial modeling and performance tracking

- Rapid creation of institutional-grade investment documents

Major financial institutions including Bridgewater’s AIA Labs, NBIM, Commonwealth Bank of Australia, and AIG report productivity gains up to 20%, along with improved data quality and decision-making. Claude’s AI-driven tools have compressed underwriting timelines, enhanced accuracy, and empowered analysts with advanced, on-demand capabilities.

"Claude has fundamentally transformed the way we work at NBIM. With Claude, we estimate that we have achieved ~20% productivity gains - equivalent to 213,000 hours. Our portfolio managers and risk department can now seamlessly query our Snowflake data warehouse and analyze earnings calls with unprecedented efficiency. From automating monitoring of newsflow for 9,000 companies to enabling more efficient voting, Claude has become indispensable." - Nicolai Tangen, CEO at NBIM

Getting Started with Claude

Claude’s Financial Analysis Solution is available now, with options for custom development and integration. Procurement is simple through AWS Marketplace, with Google Cloud support coming soon. Anthropic offers tailored demos and support to help organizations quickly harness the value of AI-enhanced financial analysis.

Key Takeaway

Claude for Financial Services is redefining how institutions analyze data, manage risk, and make strategic decisions. By merging best-in-class AI with a secure, integrated ecosystem, Claude empowers finance teams to work faster, smarter, and with greater confidence in a complex world.

Claude is Modernizing Financial Services with AI-Driven Analysis